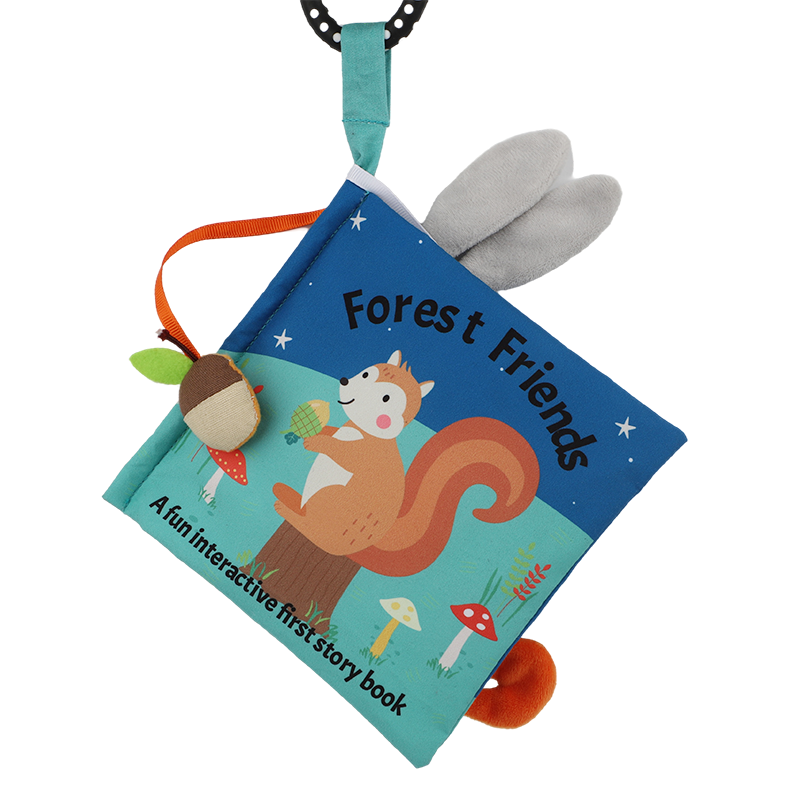

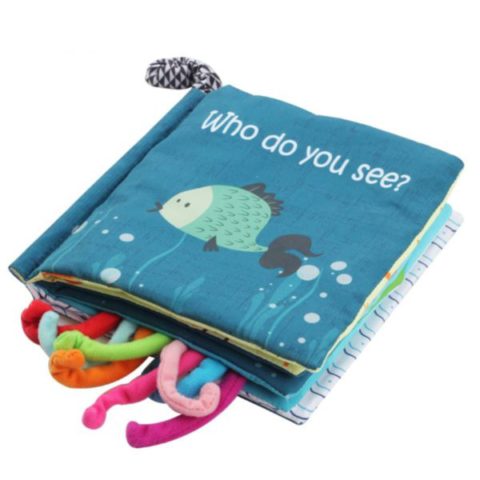

Always care safe, quality and design

Most satisfactory & considerate service

Always care safe, quality and design

Most satisfactory & considerate service

Creative & popular element

Professional design team

About Us

Jinan Wellda Trade Corporation Ltd.

Jinan Wellda is a professional baby products manufacturer, exporting for more than 14 years since 2007. We established a factory in 2009. Our factory has BSCI audit and Disney FAMA. Welcome to visit our factory when you are available! Only 15 minutes from airport.

Company goal is to make safe and nice baby products for baby having a wonderful and comfortable childhood! Quality and service are most important for us.

Products we made are mainly export to EU market, America market, Australia market. And many customers will do tests to meet their requirement, like USA customer will do CPSIA standards tests, European customer will do EU standard EN71 test, they are all passed.

视频播放失败,请联系站点管理员!

News information

Send Message

CONTACT US

Wechat/WhatsApp:

+86 135 8315 8054

Kafuka 809-810, 53 Jiluo Road, Tianqiao District, Jinan, China

Please note we are predominantly a business to business company and deal with mass production only. Our minimum order quantities tend to be the region of 3000 copies/pieces. Please give us an email or message via What’s app, Wechat, using the details above if you could like talk through a project or find out how we might be able to help you.